If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

ATTRITION

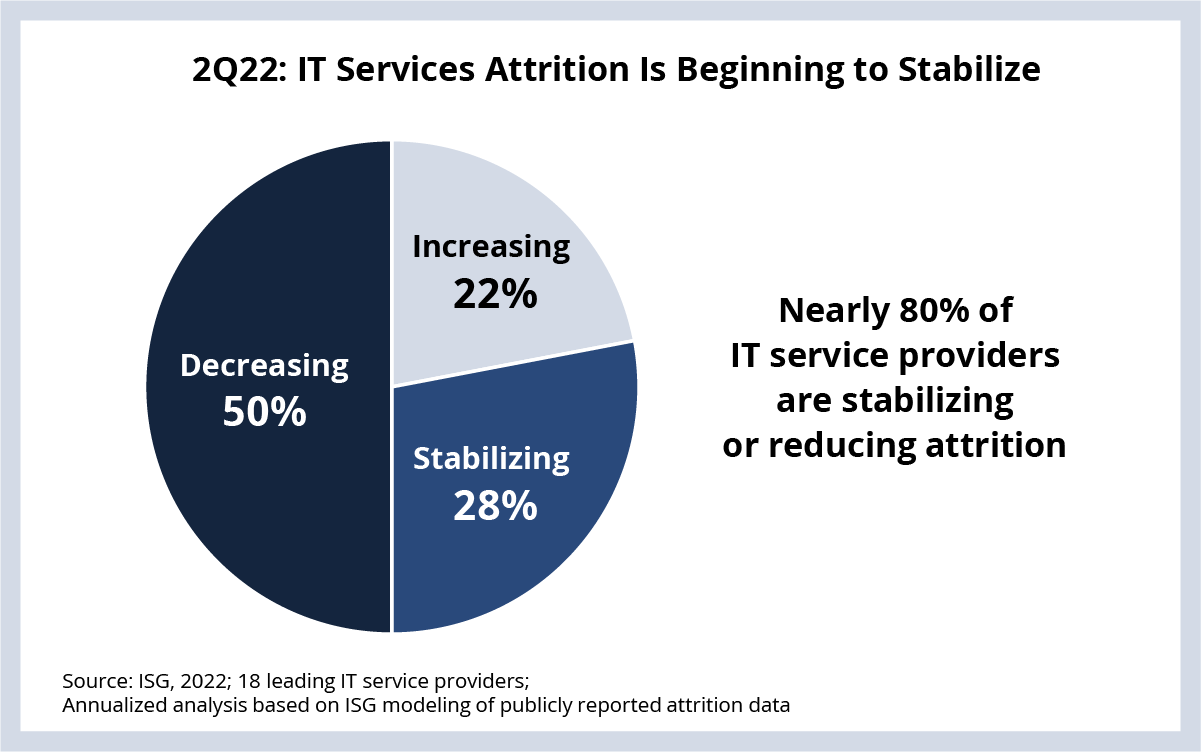

Attrition is stabilizing – or reducing – for most IT service providers. But it’s still elevated from pre-pandemic levels.

Why it matters: The biggest challenge for the IT services sector coming out of the pandemic is access to talent. Enterprises have been struggling with attrition-related delays, while providers have been struggling to find resources to meet demand.

Background: Most service providers report attrition on a last-12-months (LTM) basis. Given that the challenge has peaked over the past few quarters, the LTM measurement makes it appear to be worsening. However, looking at attrition through an annualized lens – which projects forward the current situation – we see a different picture.

The details:

- 50% of the providers we analyzed are decreasing attrition, while 28% are stabilizing it. 22% are continuing to see attrition increase (see Data Watch).

- The firms that are seeing stabilized or reduced attrition represent an even distribution of company sizes, so it’s not just the big firms that are seeing improvement.

What’s next: While things are improving, attrition levels are still elevated from pre-pandemic norms. And providers – and their customers – will be working through the implications of this massive people reshuffling for quarters to come.

DATA WATCH

EUROPE

IT services bookings in the UK and Ireland remain strong. 2Q22 represents the third consecutive quarter of more than $1 billion in ACV for the region.

Why it matters: Three consecutive quarters over $1 billion in ACV indicates healthy demand for IT services in the region in a post-Brexit environment.

The bigger picture:

- UK and Ireland typically represent 20-30% of the ACV in EMEA, so the performance in this region has a big influence on the entire region.

- Financial Services, Healthcare & Pharmaceuticals, and Telecom and Media are generating the growth.

- 1H22 saw more than 500 awards signed in EMEA, a new record.

What’s next: While we see some slowing of decision-making in pockets in Europe, we’re not seeing any significant changes in demand, even with the myriad of macroeconomic and geopolitical factors at play in the region.