Hello. This is Alex Bakker standing in for Stanton Jones with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

As part of our forthcoming State of Enterprise AI Adoption report, ISG Market Lens recently ran our largest-ever study of AI use cases, looking at over 1,200 highly funded use cases from 400 companies. Our report will be released at our Sourcing Industry Conference next week. We want to preview some results here.

What You Need to Know

Organizations want AI value. But as the recent MIT report “The GenAI Divide: State of AI in Business 2025” showed, of publicly disclosed AI pilots, only 5% are delivering value with most having no impact on P&L at all.

Our study looks at the problem a bit differently. We asked 400 large enterprises to evaluate their top three most well-funded AI pilots (not just GenAI). We also did not limit our findings to evaluate P&L metrics alone. It is practically a truism that, in large corporate IT environments, it is hard to assess the direct impact of applications on P&L metrics, especially if the applications are embedded in a web of technology integrations and business processes. To put it in context, the average organization in our study has between 1,500 and 2,000 applications and around 50 services providers.

Our results show that about one-third of all AI use cases in production tend to be overdelivering on their metrics. Where our findings largely agree with MIT is that organizations tend to show weak attribution from AI directly to P&L metrics, while metrics like compliance, quality and risk management show improvement.

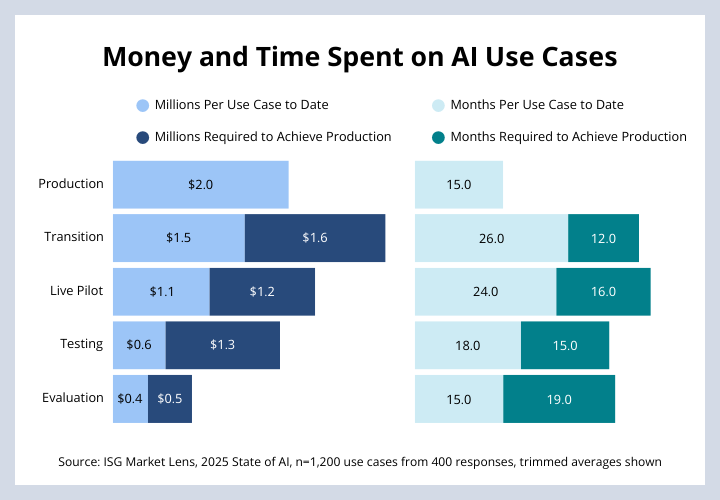

What might stand out more than P&L metrics is a look at spending versus timelines for use cases that are in production to date and still in development. Our findings show that organizations that have use cases in production figured out what worked fast, spent modestly and started to see results. Use cases that are not in production yet are moving more slowly, with both spend and timelines showing organizations still have some distance to go.

Data Watch

What’s Next?

Thomas Edison once said his failures had taught him “a thousand ways not to make a lightbulb.” In much the same way, based on the 1,200 use cases in our study — and the results MIT has put forward — AI is also progressing through many experiments before finding success.

Between last year and today, however, organizations have made real progress in adopting AI. If this year’s use case data is any indication, many are setting out on journeys that will extend well into the coming years. As more production use cases emerge, it’s becoming easier for peers to learn from each other and share the maps of this newly charted territory.