Hello. This is Stanton Jones, Sunder Sarangan and Amanda Lytle with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Hiring

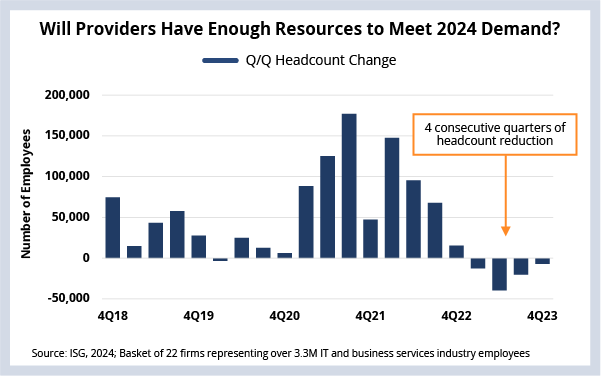

By headcount, the IT and business services industry is 2% smaller than a year ago. However, 2023 saw record contract bookings of over $40 billion. Will providers have enough resources to meet 2024 demand?

Background

As we discussed in the fourth quarter of last year, service providers have been delaying hiring – especially at the entry levels – in response to softness in discretionary enterprise spending.

When these delays combined with ongoing attrition in 2023, the industry saw four consecutive quarters of Q/Q headcount reduction (see Data Watch). This means total headcount in the IT and business services industry is lower today than it was this time in 2022.

But, as we shared on the 4Q and full-year Index call in January, the industry had a strong year in 2023. Managed services bookings hit a record high, up 5% year over year.

The Details

- Industry headcount is down 2.4% after four consecutive quarters of headcount reduction.

- Only 350,000 people were hired in the last 12 months, which makes up approximately 11% of the workforce.

- Last 12 months attrition is 13.5%, which is approximately 430,000 people.

What’s Next

In our view, it’s a matter of when – not if – discretionary demand returns. As we discussed in January, we think we’ll see a more conducive environment for technology and transformation spending as inflation continues to cool. That will lead to increased spending in areas like application modernization and public cloud and particularly those led by generative AI.

This is a key reason we’re forecasting 4.25% growth in managed services ACV and 15% for as-a-service. Assuming this is the case, will the industry be ready to meet this demand?

We think the answer is yes, with a caveat. Providers can rev up hiring engines quickly and can turn back to lateral hiring and the subcontractor channel if needed. They did this in a big way after the pandemic, so it’s a proven model. And this next wave of demand is likely to ramp up more slowly, starting in 2H24.

The caveat here is the impact on service delivery. If a provider waits too long to ramp hiring back up, it puts a huge amount of pressure on existing staff, driving up utilization rates that are already above long-term averages. This in turn puts pressure on growth since there are very few people available to take on new projects. Eventually, this rolls down to clients and to ongoing engagements, who are likely to see the impact on their service delivery.