If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

INCUMBENCY DATA

At the end of 2022, ISG conducted a survey of our transaction advisors to better understand client-provider relationships in the market. We wanted to know what leads enterprise clients to competitively bid their outsourced IT work.

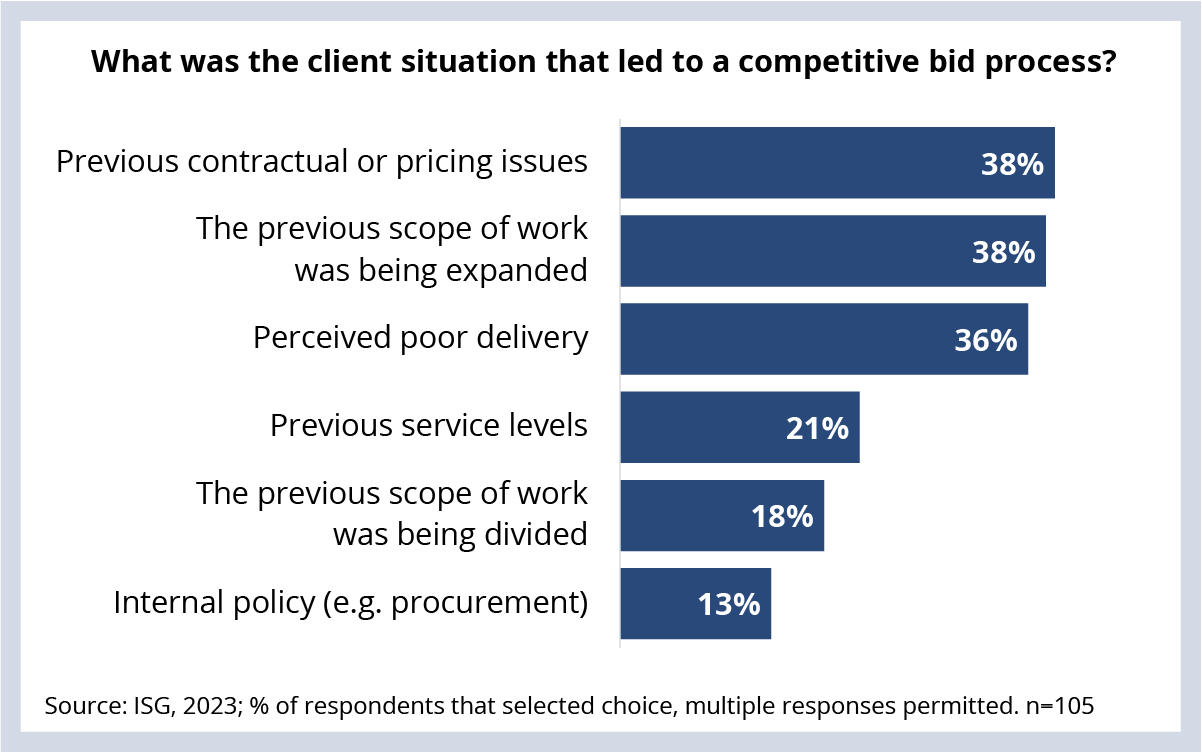

The two most common reasons for competitive bids were 1) the existence of previous contractual or pricing issues with the incumbent and 2) expanding scope of outsourced work. The third most common reason for a competitive bid was the clients' perception of poor delivery from the provider. (See Data Watch.)

We have talked before about the fact that incumbency in competitive deals is typically a disadvantage, with the incumbent losing some or all scope 70% of the time in a competitive transaction. Our latest data shows that the most common motivations that lead enterprises to the deal table have to do with issues with the incumbent.

The existence of previous contractual or pricing issues points to the disadvantage incumbents face once they are in a competitive transaction. And, when faced with other providers in a competitive situation, most incumbents do not adequately address the relationship issues that led the client back to the RFP table in the first place. Providers need to stay focused on relationship health throughout the deal term, but they need to especially focus on remediation at least 18 months before renewal.

The second most common reason also ties to incumbency. It is not uncommon for us to see current providers for different scopes of work being invited to bid on deals. The implication is that successful delivery on different scopes can spur clients to add a provider to an invite list. According to the latest ISG Index data, IT services firms under $3 billion in revenue are growing at a forecasted rate that is slowing relative to larger firms, compared to one year ago. This, along with the prevalence of expansion of existing work, suggests that vendor consolidation may be a growing trend.

The final component of incumbency data that we have not evaluated but are looking into is the relative impact of the provider’s autonomy in performing the work. We are examining the effect of a staff-augmentation model versus a managed service model on incumbent providers’ performance in a competitive pursuit.

DATA WATCH