If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

PRICING

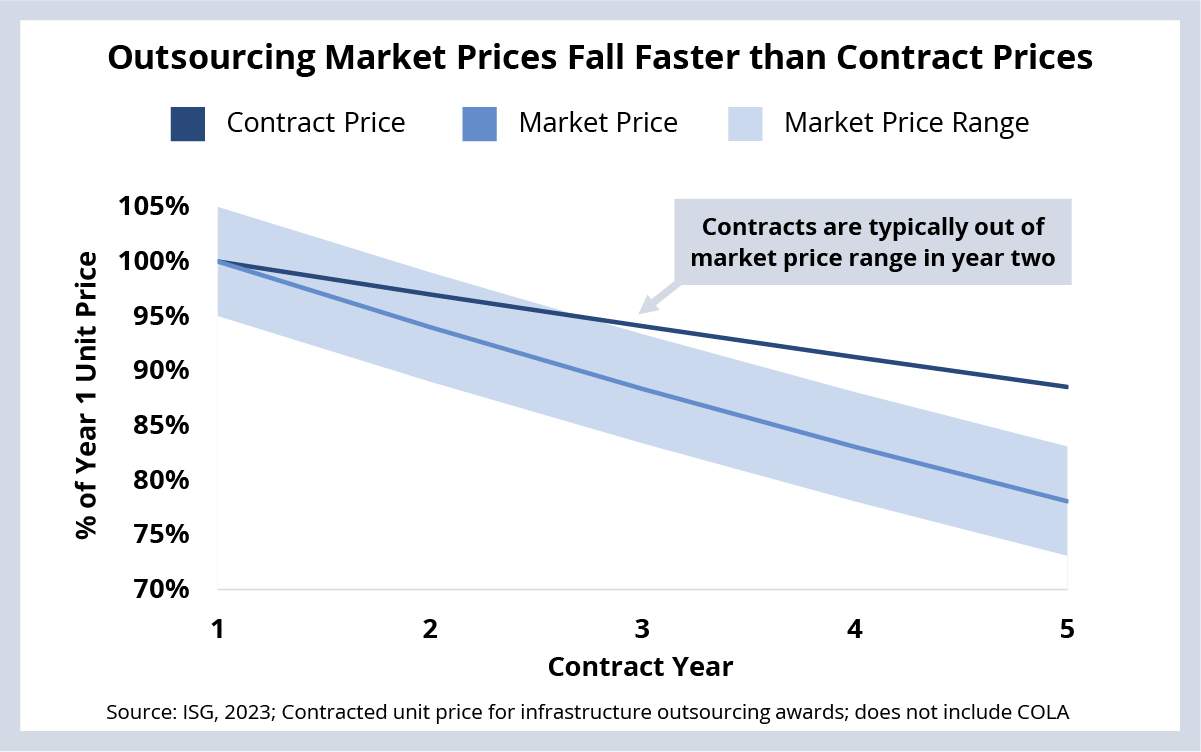

Contractually committed prices for infrastructure outsourcing awards continue to decline. However, market prices are falling even faster as productivity improvements and competition drive them down.

Background

Last year we discussed at length the fact that providers have had limited pricing power for outsourcing services, even in the face of significant wage inflation.

There are lots of reasons for this. Productivity continues to increase as providers automate everything from patching servers to re-writing legacy code. Huge numbers of new hires have come online – oftentimes in smaller, lower-cost delivery locations. And, of course, competition continues to be intense, driving down prices to win new business.

All these factors add up to the continuation of a trend we’ve seen for many years now: infrastructure outsourcing prices are declining despite inflation and wage increases.

The Details

- When an infrastructure outsourcing contract is signed, the average cumulative unit price reduction over a five-year period is between 10% and 30%, depending on how much transformation is involved.

- With more transformative deals, price reductions are typically in the high single digits early in the agreement, going down to mid-single digits for the remainder of the term. For generation-two and generation-three deals, declines are generally smaller and spread more evenly over the contract term.

What's Next

While a service provider may commit to year-on-year price declines in a contract, it’s important to note that market-based prices fall even faster. For example, for a typical generation-two or -three deal, the market price reduction can sometimes be as much as twice as what’s committed in a contract. That means that in the middle of the second year of an award, the unit price for services is often already out of market range (see Data Watch).

This is not unexpected. Even for generation-two and -three agreements, there is inherent forecasting and financial risk for service providers.

The price glide path is different for awards with significant transformation in scope. Most of these agreements have steeper year-one and year-two price declines, driven by investments in automation and improved service delivery. After year two, price reductions start to look more like a generation-two or -three agreement.

So, buyers that are looking for near-term cost optimization opportunities (which is very important in today’s uncertain economy) will want to think about the degree to which they can transform their environment to enable more near-term savings. This will also have the added benefit of keeping the contract within the market price range longer.

DATA WATCH