Enterprises across industries are moving workloads to the cloud, and, in doing so, they are growing their cloud estates rapidly in hyperscaler environments. While such tremendous consumption of cloud resources and services from hyperscalers is critical to meet technology and strategic goals, it has become clear to enterprises that they need effective cloud cost management.

Cloud environments are increasingly complex, running large volumes of datasets and logic. To manage cloud costs at scale, existing traditional FinOps models are evolving to employ more intelligent mechanisms and features.

Public Cloud Services are Expected to Reach $600 Billion in 2023

Source: FinOps Foundation, McKinsey, Forbes review.

How Does FinOps Benefit the Business?

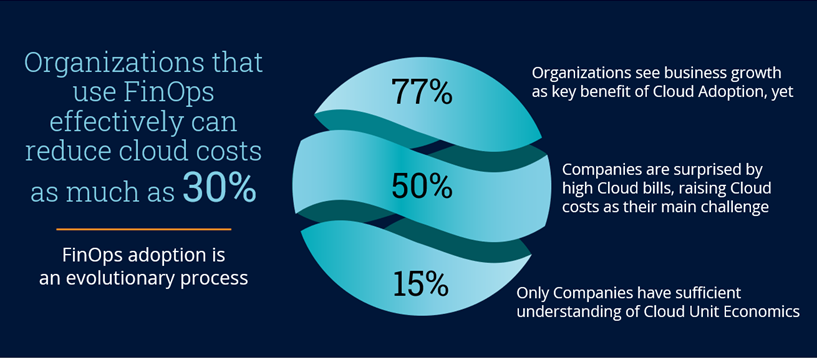

Enterprises are widely embracing FinOps for its wider business benefits rather than looking at it only from the technology side.

While FinOps is most effective when organizations implement it from the start, introducing it at just about any point during a company’s cloud migration journey can deliver significant benefits. Most enterprises would benefit from introducing FinOps capabilities earlier – even before embarking on the cloud journey. The longer an organization waits to implement FinOps, the greater the cost and effort it takes to move away from a datacentre mentality and toward cost-effective cloud consumption, leading to a higher “capability debt.”

Here are some benefits of FinOps to the business:

- Cloud cost transparency and accountability: FinOps breaks down costs by projects, departments or business units, allowing stakeholders to understand their financial impact. This transparency fosters cost accountability, enabling teams to make informed decisions about resource allocation and budget management.

- Cloud cost optimization: By actively managing and monitoring spending, organizations can identify cost-saving opportunities, eliminate wasteful spending and optimize resource utilization. This leads to significant cost reductions and improves overall financial efficiency.

- Business agility and scalability: With FinOps, organizations can scale their technology infrastructure more efficiently. By optimizing costs and resource utilization, organizations can allocate their financial resources effectively, enabling them to scale up or down as needed. This agility allows businesses to respond quickly to changing market demands and improve their competitive advantage.

- Collaboration and alignment: By bridging the gap between financial, operational and technology teams, organizations can align their technology investments with business outcomes. This collaboration enhances communication, understanding and decision-making, leading to more effective financial management.

- Automated workflows: As your FinOps infrastructure evolves, you can use automation to streamline your workflows, pre-configure different instance types to match business priorities and automate server tagging, etc. Automated workflows also lead to a reduction in cloud-related energy consumption (more than ~2% of global spending) and, therefore, a reduction in the organization’s carbon footprint.

- Financial governance: FinOps establishes financial controls, tracks spending against budgets and ensures adherence to financial best practices. This enables organizations to manage financial risks effectively and maintain compliance with regulatory requirements.

How Will AI Influence FinOps Models in the Future?

Artificial intelligence (AI) is likely to play a more significant role in future FinOps models. AI-powered algorithms and predictive analytics can provide more accurate cost forecasting, anomaly detection and optimization recommendations. The future FinOps models may leverage AI to automate cost optimization, streamline financial processes and provide real-time insights for decision-making.

With the evolution of FinOps, diverse pricing models are also emerging. “Pay as you go,” “pay for savings only” and other gain-share models are becoming more attractive for enterprises with complex cloud estates and high cloud consumption.

Here are some features of AI-powered FinOps in the future:

- Advanced predictive analytics: AI can enhance predictive analytics in FinOps by analyzing historical data, market trends and external factors to predict future consumption patterns. Future FinOps models that employ AI algorithms will provide more accurate cost forecasts, predict budget overruns and anticipate potential cost-saving opportunities or risks in advance.

- Real-time anomaly detection: AI can enable real-time anomaly detection to identify irregularities or unusual spending patterns that may lead to increased costs. AI-driven FinOps models can continuously monitor financial and operational data, detect anomalies and generate alerts for immediate action, helping enterprises proactively address cost-related issues. By identifying deviations from normal usage patterns, these models can help organizations address issues like unauthorized usage, security breaches or resource waste.

- Cognitive financial assistants: Financial assistants powered by AI can provide real-time insights, answer financial queries and assist with decision-making. Leveraging natural language processing (NLP) and machine learning models, these assistants can analyze financial data, interpret complex financial information and provide relevant recommendations or explanations.

- AI-powered decision support: By analyzing data, market trends and other relevant factors, AI algorithms can generate recommendations supporting decision-making, such as cost-saving initiatives or pricing strategies. AI will be able to help compare cloud service providers based on their pricing models and services. And by analyzing various factors such as workload requirements, service-level agreements and pricing structures, AI models can provide recommendations on the most cost-effective options for specific workloads or applications.

- Accurate invoice analysis: By leveraging natural language processing (NLP) and machine learning algorithms, these models can help organizations understand invoice components, track spending trends and identify opportunities for cost savings. AI can streamline financial reporting processes by automating data collection, analysis and report generation. Future FinOps models may leverage AI to extract relevant financial information from various sources, perform data consolidation and generate accurate and insightful and timely reports.

- AI-driven risk management: Analyzing data patterns, risk indicators, and usage metrics, these models could identify potential compliance violations, security vulnerabilities, or unauthorized spending. This empowers organizations to proactively manage financial risks and protect their financial stability.

Unlock the Value of FinOps for Your Business

The integration of AI technologies in FinOps will empower organizations to gain better control over cloud consumption and spend, optimize costs, and improve decision-making to drive greater efficiency and agility in cloud financial operations. FinOps powered by AI will enable organizations to leverage data-driven insights and automation to achieve financial discipline, maximize the value of cloud investments and stay competitive in the rapidly evolving cloud landscape.

AI-driven FinOps helps align cloud spending with business goals and priorities. By providing granular insights into the cost drivers of various workloads and applications, organizations can make data-driven decisions about resource allocation, prioritize investments, and optimize spending to support strategic initiatives. AI also enables organizations to quickly adapt and respond to changing business needs and market dynamics.

ISG helps enterprises manage their cloud consumption and spend. Contact us to find out how we can get started.