Hello. This is Alex Bakker with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Generative AI

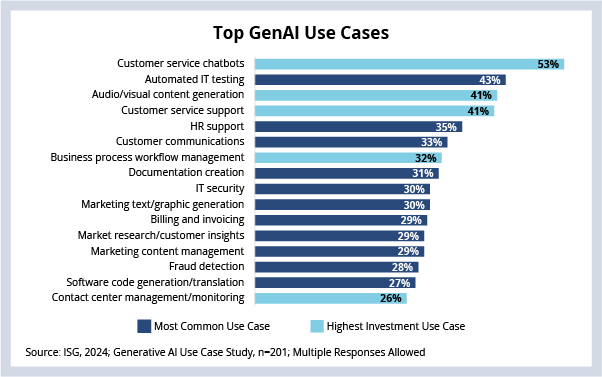

Generative AI (GenAI) use cases span a broad spectrum of business domains, but the most well-funded use cases today are primarily focused on customer service.

Background

Earlier this year in our study about AI adoption plans and objectives, we discussed how enterprises were focusing their AI objectives on business outcomes. At the time of that study, most organizations had placed importance on generating new revenue but were not having great success generating any. At the time we said:

For IT service providers, the rapid adoption is both a blessing and a curse. On the positive side, AI is still a technology that businesses need help enabling and operating, and service providers have the experience to drive technology adoption, transformation and efficient operations. On the negative side for providers is the novelty of the technology and enterprises’ explicit focus on revenue when it comes to AI. This puts IT services providers in the difficult position of having to help their clients not only operate their technology but also operate their businesses.

Since then, we did some research to find out in which GenAI use cases organizations have invested so far. What we found is that GenAI use cases in organizations are a few degrees removed from direct revenue generation, and the focus on customer experience and contact center operations has a more distant link to future revenue than near-term revenue growth.

Data Watch

Details

In our recent GenAI use case study conducted in August 2024, we asked companies which use cases they have invested in to date (dark blue bars in the chart above) and which have received the most funding to date (light blue bars in the chart above). Of the top five most well-funded areas, three are focused on contact center, one on efficiency and one on “default” use cases for GenAI more broadly.

Some of the top areas into which companies have integrated AI reach farther – testing, HR, customer communications, documentation – and the use cases that get the most funding are aimed at efficiency and profitability, not revenue. We also found AI tools tend to be deployed in processes with a “human in the loop” (HITL) to intermediate and validate the output before it is delivered to customers.

The practical outcomes of investment to date are improved quality – e.g., better graphics, better responses to customer inquiries, better process management – and, to some extent, better efficiency – e.g., reduced response times and faster resolutions. But as long as the use cases serve to augment humans, the human’s ability to operate the process will still ultimately be the limiting factor.

Focusing on quality improvements and HITL processes are both important, liability-limiting factors for GenAI right now. It means AI results are reviewed before they are trusted with the goal of improving the quality of output over time. Given the concerns about AI hallucinations and unclear IP restrictions for use in many large AI training sets, both these limitations seem reasonable for the initial use cases.

What's Next

As the GenAI industry matures, enterprises need solutions to two problems:

- The ability to operate GenAI without the constraints of HITL processes, so they can start getting returns that scale in a non-linear way.

- A progression from quality and efficiency toward growth and new products.

At this point, organizations will probably focus on diversifying their use of GenAI across HITL use cases and embrace AI-driven services that incorporate efficiency improvements. Over the longer term, enterprises will need better understanding of the risks and better risk mitigation models, combined with further technical progress, to try use cases with greater scale and ROI.

Download the State of the Generative AI Market Report 2024 here.