Did someone forward you this briefing? If so, subscribe here to get a copy of the Insider in your inbox each Friday.

ADM

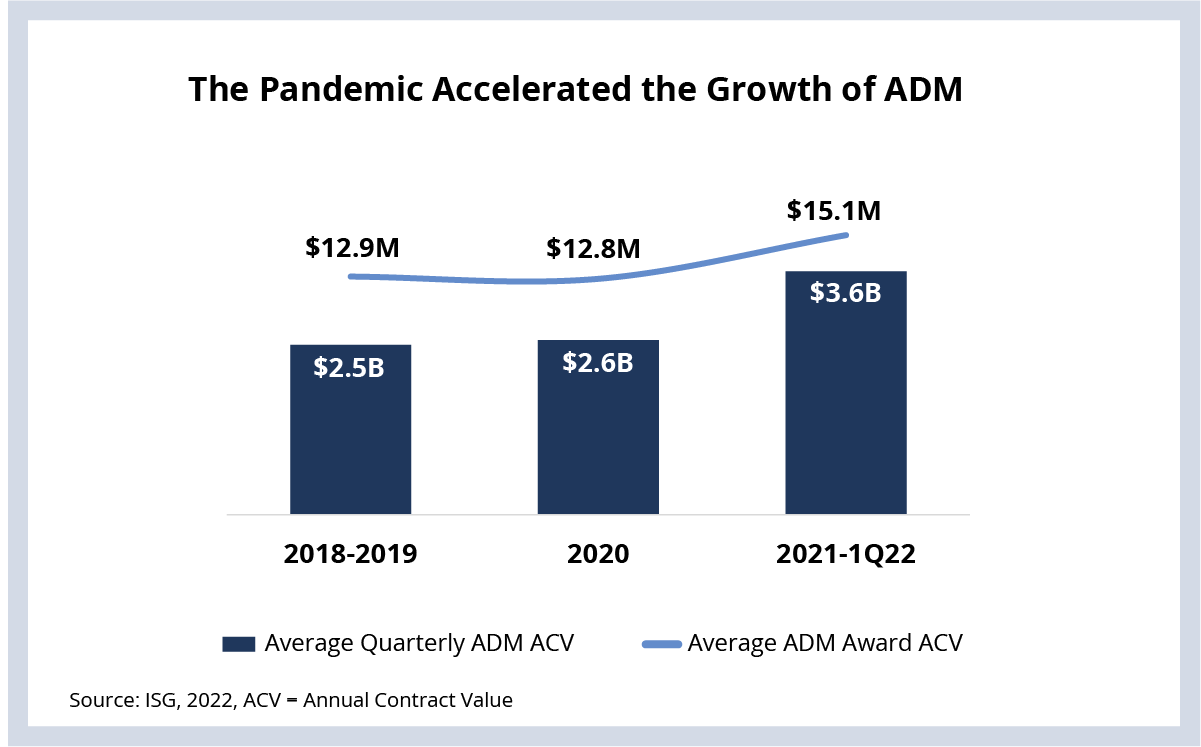

As we discussed on the 1Q22 Index call last week, ADM annual contract value (ACV) was down slightly for the quarter, but still topped $3 billion for the fifth consecutive quarter. Average quarterly ACV is almost 40% higher than the pandemic-impacted quarters of 2020 and is higher than that when compared to pre-pandemic quarters. ADM award sizes are up as well – average award ACV is up almost 20% over the pre-pandemic period (see Data Watch).

ADM ACV is now more than 55% of the total ITO ACV in the market – that’s a big change from a few years ago. As we have discussed at length, the pandemic accelerated the shift away from infrastructure outsourcing (which is down 11% Y/Y) and toward cloud – which is in turn creating demand for application transformation. As companies modernize legacy applications and create cloud-native applications, ADM will continue to take more share of the ITO market.

This surge in demand for applications is also driving big changes in the way companies buy and manage ADM services. Modern sourcing and delivery models will be a big focus at our SourceIT event next month. And there is no one on the planet who knows more about this topic than my colleague Ola Chowning. She’ll be leading a couple of important sessions on this topic, so hope you can join us next month in Paris.

DATA WATCH

CYBERSECURITY

We’ve talked a lot about how active private equity has been in IT services of late. Recall that in 2021, PE firms made seven $1 billion-plus transactions in the IT services sector. PE investments are continuing in 2022 in the red-hot cybersecurity space.

Thoma Bravo is acquiring identity management provider SailPoint for nearly $7 billion. And network monitoring software firm Kaseya (owned by Insight Partners) announced its intent to buy MSP security software firm Datto through an Insight-led consortium for over $6 billion.

This cybersecurity software M&A activity has important implications on the services sector. As my colleague Doug Saylors talked about last week on the Index call, service provider leaders in this space all have one thing in common: software platforms are at the core of their client delivery.

We’ll be talking about these and other important cybersecurity-related topics at our inaugural Secure, Intelligent, Connected Enterprise event in New York in July.