If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

TALENT & ATTRITION

We discussed on the 1Q22 Index call a couple of weeks ago that the revenue-weighted attrition for the industry was 21.2% based on numbers reported for the quarter ending in December. The industry has seen similarly high attrition levels before, but the current situation is unique in that it’s combined with a massive spike in demand for IT services.

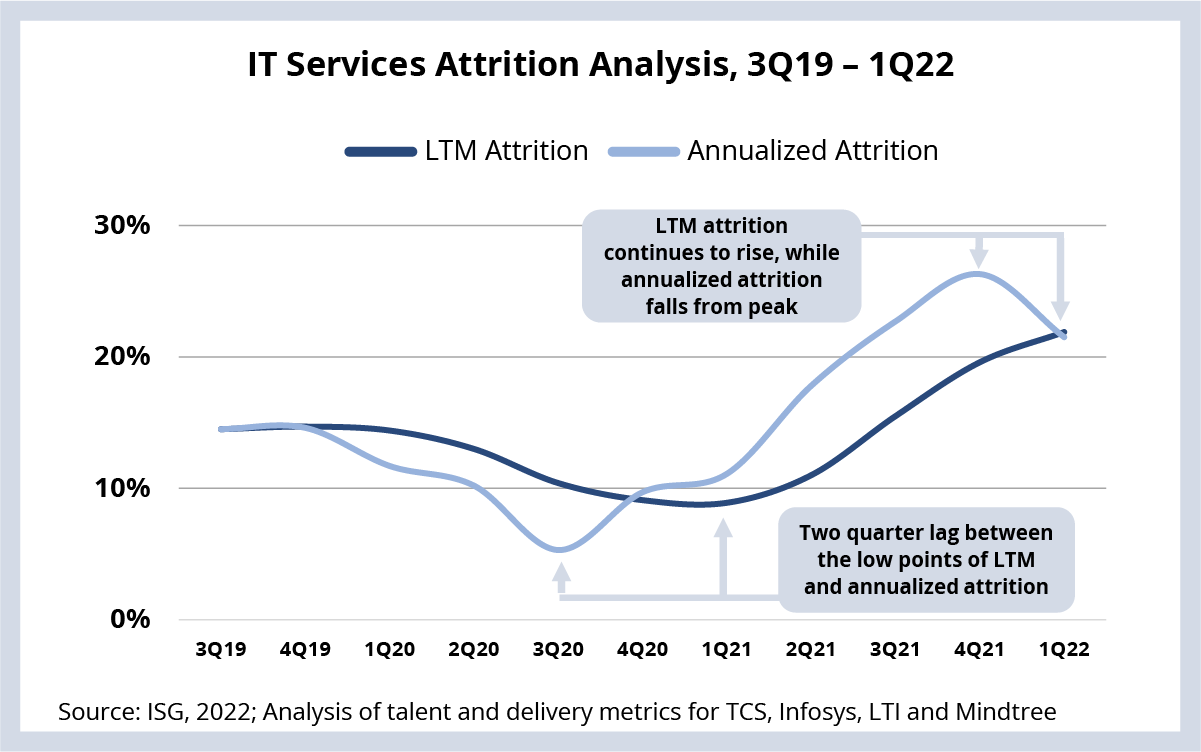

We think the attrition problem may have peaked in December 2021. Here’s why: just about every provider now reports attrition on a “last 12 months” (LTM) basis. This averages out attrition spikes and dips, but it’s a backward-looking metric that does not indicate what might be coming.

To better explain this, let’s compare the two ways to measure and report attrition. First, LTM looks at the employees who left a company in the preceding 12 months, relative to the company headcount during that period. This is what most providers report on a quarterly basis. On the other hand, annualized attrition – which very few providers report – provides a point-in-time view of attrition based on the current quarter’s level.

What does this mean in real terms? We looked at four providers and their recently reported earnings: TCS, Infosys, Mindtree and LTI. Weighted based on their headcount, LTM attrition for this group went up in Q1 from already high levels – up 2.1% for TCS, 2.2% for Infosys, 1.5% for LTI, and 1.9% for Mindtree. However, the delivery and talent metrics we track as part of our ISG Index research indicate that annualized attrition for each provider actually declined in March. This is easy to miss when only looking at reported LTM attrition (see Data Watch).

This drop in annualized attrition is a result of 1) a decline in the number of employees who left, and 2) a bigger employee base following record hiring in recent quarters. While it may take another quarter or two for reported LTM numbers to flatten, it does appear that attrition has stabilized (for now).

We are certainly not saying that another rise in attrition is completely ruled out, but we think the annualized attrition metric is strong evidence that providers are starting to reduce attrition from their peak levels, in line with what we forecasted back in the 4Q21 Index call.

DATA WATCH

CONTRACTING AND M&A ACTIVITY

- Electric aircraft manufacturer Jaunt signs $100 million engineering agreement with LTTS. As part of the agreement, LTTS will open a new R&D center in Quebec (link).

- Accenture acquiring Argentinian analytics firm Ergo (link) and European sustainability advisory firm Greenfish (link).

- Globant acquires low-code platform provider GeneXus (link).