Warm wishes to folks in Texas and other parts of the southern U.S. emerging from “Snowpocalypse.” At times like these, we’re reminded that it’s just as important to have a plan for adverse events that are likely to happen as it is to have a plan for once-in-a-generation events.

Here’s what’s important in IT and business services this week:

Auto manufacturers embrace multi-cloud

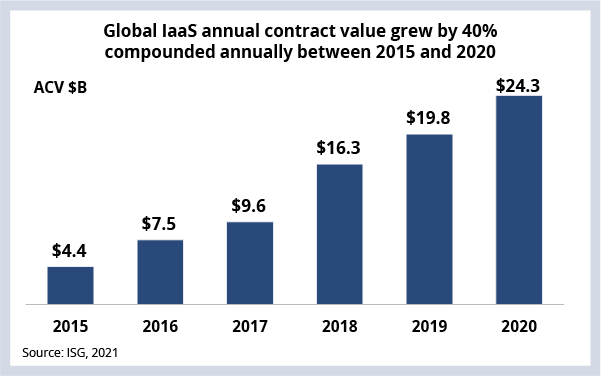

IaaS annual contract value grows at 40% CAGR

Security and collaboration fuel SaaS growth

Separating cloud transformation from cloud managed services

AUTOMOTIVE

Auto manufacturers are embracing multi-cloud. 2020 was a tough year for the auto industry. Revenues were down by about .7 percent as the pandemic pressured consumer spending and as a semi-conductor shortage slowed production. What didn’t suffer was spending on infrastructure-as-a-service. Auto manufacturers recognized they needed to reduce fixed costs, increase flexibility and, most importantly, establish a platform to analyze data and build new applications around the connected car.

You can see this surge in spending reflected in many of the recent relationships between big auto companies and cloud hyperscalers. What’s most interesting here is the number of car makers creating relationships with multiple hyperscale vendors.

BMW has announced relationships with Alibaba and AWS, Ford with AWS and Google, and Volkswagen with AWS and Microsoft. Each of these relationships is focused on different areas of the technology stack, and given our forecast for about 5 percent growth in the automotive sector globally, we expect the number and volume of these kinds of hyperscaler relationships to increase in 2021.

DATA

Enterprises across all industries are accelerating their adoption of IaaS compute, storage and database services, as well as increasing their awareness and prototyping of new services like pre-trained machine learning models and serverless computing.

PRACTITIONER'S POV

Companies should assume they are already multi-cloud. This could be due to a conscious strategy or simply to ungoverned cloud sprawl. Either way, the onus is on the enterprise to ensure the right commercial incentives are in place for their providers. This is why separating cloud transformation from cloud managed services is so important.

Think of it as three distinct roles: 1) the cloud transformer 2) the cloud broker/orchestrator and 3) the cloud manager. The cloud transformer is the “migration factory” that refactors existing workloads and builds new ones. The cloud broker/orchestrator is responsible for end-to-end service integration and operations, customization and aggregation of these services. And the cloud manager manages the workloads once they are in production, as well as the hosting environment, be it a hyperscale cloud or a private cloud in a co-location facility.

By decoupling these roles, transformation work is separated from run services, which helps optimize workloads for the right cloud – not necessarily for the cloud that generates recurring revenue for the provider.

SOFTWARE-AS-A-SERVICE

Growing demand for security and collaboration is fueling SaaS growth. Okta, a leading identity and access management SaaS firm, publishes an annual report that lists the applications with which its clients request it to integrate. Okta has over 100 million users, giving it unprecedented visibility into which applications enterprises are increasingly using – and which ones they use less often.

For the first time in the history of the report, nine out of the top 10 fastest growing apps are new to the list in 2021. It is not surprising that collaboration and security tools dominate the list given the pandemic’s massive impact on the workplace. Among the top five are collaboration solutions Miro, a whiteboarding app, Figma, an interface design tool, and Monday, a collaborative project management tool. Security tools round out the rest of the list, with firewall provider Fortinet, Sentry for application monitoring and password manager 1Password.

This is consistent with what we discussed on the Q4 Index call when we asked ISG advisors about their clients’ planned spending in 2021. Over 70 percent of the advisors we asked said their clients plan on increasing their cybersecurity spending in 2021. We expect spending on collaboration and work-from-home solutions will decrease slightly this year since companies made those investments in 2020. We’re projecting the as-a-service market as a whole to grow by over 20 percent in 2021.

DEAL ACTIVITY

- BNY Mellon and Google. U.S. bank creates collateral management and liquidity solutions on Google Cloud. Link

- Hydro One Networks and Capgemini. Canada’s largest electricity and distribution provider signs three-year ITO renewal. Link

- Highmark Health and CGI. U.S. healthcare company deploys claims auditing solution. Link

- Nest Corp and Atos. U.K. pension provider deploys new system under 10-year contract. Link

- Spirit AeroSystems and Infosys. U.S. aerostructure manufacturer integrates recently acquired Bombardier assets. Link

- Telecom Egypt and IBM. Egyptian telecommunications provider bets on Red Hat. Link

- Verkor and Capgemini. French low-carbon battery startup uses data to improve manufacturing and reduce waste. Link

MERGERS, ACQUISITIONS, ALLIANCES

- Accenture and VMware. Expansion of partnership; focus on application modernization. Link

- Global Payments and Google. Merchant acquirer builds omnichannel ordering and point-of-sale solutions. Link

- SAP and AppGyver. Growth in low-code/no-code platforms surging. Link

- TELUS and Google. Canadian telecommunications company inks 10-year co-innovation agreement. Link

- TietoEVRY and Quorum. Finnish IT software and service company divests its oil and gas software business. Link