If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

ADM & CLOUD

We’ve discussed at length over the past year the tremendous growth in application outsourcing contract value. And although ACV growth was flat in 1Q22, remember that 2021 full year ACV was up 40% Y/Y. So the flattish result in Q1 is really due to a tough comparison to 4Q21.

ADM now represents more than 55% of the ITO market. And this number is likely to keep growing as infrastructure outsourcing continues to decline. Infrastructure ACV was down 11% in 1Q22, on the same downward trajectory we saw in 2021.

The question is: what’s driving this growth? We know, of course, that as companies digitize their operations and customer interfaces, a lot of applications are getting modernized and created. What often gets overlooked in this process is the fact that this modernization and creation is increasingly happening in the cloud. So, in our view, cloud is serving as a forcing function for ADM.

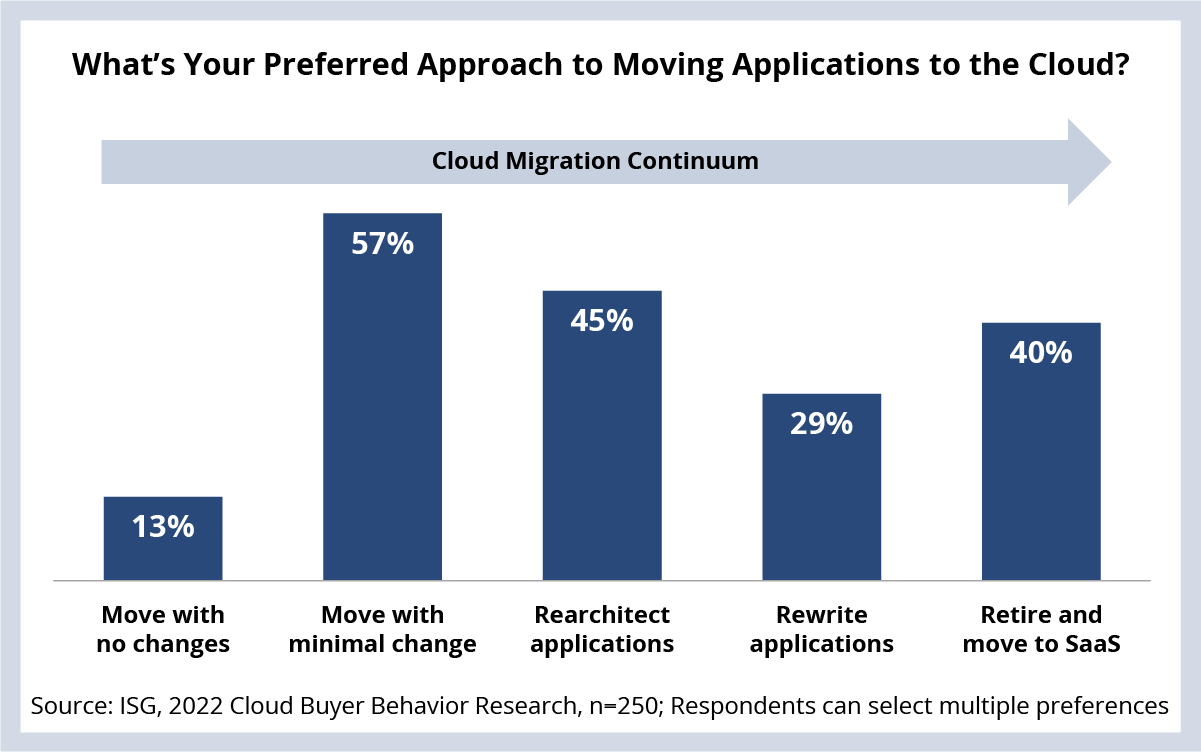

Enterprises have a lot of options as they move their applications to cloud. They can lift and shift, refactor them to work better on a cloud architecture, re-write them as “cloud native” applications, or retire them and move them to software-as-a-service. This is exactly what we looked at in our most recent buyer behavior study. What approaches are large enterprise CIOs taking?

As expected, they are using all of them. As you can see in this week’s Data Watch, pretty much every approach is in play. And this makes sense as large enterprises can have thousands of applications. However, the preferences tend to lean towards moving applications by making minimal – or significant architectural changes.

And it’s our view that as long as preferences skew to the left of the chart, we believe that will also signal strong demand for application outsourcing to help remediate a lot of issues companies run into when they only make minor changes – things like unexpected costs around resource allocation and security.

And given this is where most big companies are today, it’s a key driver for the big growth in ADM last year, and a big reason there is such intense interest in the $6.5 billion of ADM renewals up for grabs this year.

ADM now represents more than 55% of the ITO market. And this number is likely to keep growing as infrastructure outsourcing continues to decline. Infrastructure ACV was down 11% in 1Q22, on the same downward trajectory we saw in 2021.

The question is: what’s driving this growth? We know, of course, that as companies digitize their operations and customer interfaces, a lot of applications are getting modernized and created. What often gets overlooked in this process is the fact that this modernization and creation is increasingly happening in the cloud. So, in our view, cloud is serving as a forcing function for ADM.

Enterprises have a lot of options as they move their applications to cloud. They can lift and shift, refactor them to work better on a cloud architecture, re-write them as “cloud native” applications, or retire them and move them to software-as-a-service. This is exactly what we looked at in our most recent buyer behavior study. What approaches are large enterprise CIOs taking?

As expected, they are using all of them. As you can see in this week’s Data Watch, pretty much every approach is in play. And this makes sense as large enterprises can have thousands of applications. However, the preferences tend to lean towards moving applications by making minimal – or significant architectural changes.

And it’s our view that as long as preferences skew to the left of the chart, we believe that will also signal strong demand for application outsourcing to help remediate a lot of issues companies run into when they only make minor changes – things like unexpected costs around resource allocation and security.

And given this is where most big companies are today, it’s a key driver for the big growth in ADM last year, and a big reason there is such intense interest in the $6.5 billion of ADM renewals up for grabs this year.

DATA WATCH

CONTRACTING AND M&A ACTIVITY

- Building materials manufacturer Swiss Krono sings 5-year infrastructure and apps agreement Kyndryl (link).

- U.K. retailer Freemans Grattan Holdings signs 5-year infrastructure and apps agreement with Tech Mahindra (link).

- Cyient makes its biggest-ever acquisition with product engineering firm Citec (link) and Singapore-based mining and energy specialist Grit Consulting (link).

- Wipro acquiring SAP consulting firm Rizing (link).

- CGI acquiring French BFSI consulting firm Harwell Management (link).

- Thoughtworks acquires Canadian CX and product development firm Connected (link).