If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

ATTRITION DROPS, BUT TALENT CHALLENGES WILL REMAIN

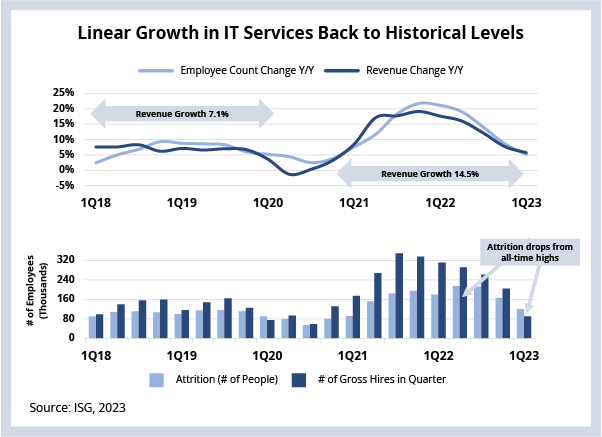

Annualized attrition in the sector has dropped to 12%. This is a significant decline from the peak of 24% in 2Q22 and 18% last quarter. However, for the first time since 1Q20, providers hired fewer people this quarter than the number of people who left. The likely implication of this is that enterprises will see lower turnover in their delivery teams but the drop in attrition is unlikely to reduce ramp-up times for new work and delays in finding talent, especially for in-demand skills.

DATA WATCH

Providers Growing Revenue by Hiring at Scale

Over the last two years, service providers lost 1.4 million employees, but they added more than 2.2 million new employees. At the peak of the supply-side crunch, providers were hiring nearly two employees for every one that left.

This was the “Great Reshuffle” we discussed at length last year. The record hiring was crucial for providers to address the exceptionally strong demand for managed services and digital transformation.

Providers’ ability to hire, onboard and deploy talent at scale enabled them to double the pace of revenue growth, going from an average of 7.1% per quarter in 2018-19 to 14.5% per quarter in 2021-22. This revenue growth was driven by an unprecedented level of hiring; as a result, employee counts grew faster than Y/Y revenue growth.

Then in 2022, hiring rates started to decline as you can see in this week’s Data Watch. The gap between growth in employee count and revenue has been slowly closing over the previous six quarters. This quarter, they are at parity.

Providers Shifting Their Stance for Growth

Most managed services providers rely primarily on campus-based hiring, supported by lateral hiring to support growth. During the post-pandemic demand surge, providers had to rely on a “just-in-time model,” including greater use of subcontractors.

This approach put pressure on provider margins while the sector today has very limited spare “people” capacity. Therefore, providers are laser-focused on optimizing their delivery pyramids and the mix of onshore-offshore delivery. Because of all this, we expect hiring to be somewhat subdued compared to the unprecedented numbers of last two years.

What Can Enterprises Expect Now?

The good news for enterprises is lower turnover in their delivery teams, a major challenge during the last two years. However, given the shifting growth stance of providers, enterprises should expect to see more junior resources on their accounts, as well as more work delivered offshore. They should also expect to see less reliance on subcontractors.

While these changes may lead to service delivery challenges for enterprises in the near term, we have seen the adaptability and resilience in the delivery capabilities of providers that bodes well for enterprises and their partnership with providers to adjust to the changing market conditions.