Special note: Chris and I, as well as dozens of other ISG leaders, will be at our annual service provider event in Dallas, Texas, next week. You still have time to register here.

If someone forwarded you this briefing, consider subscribing here.

PRICING

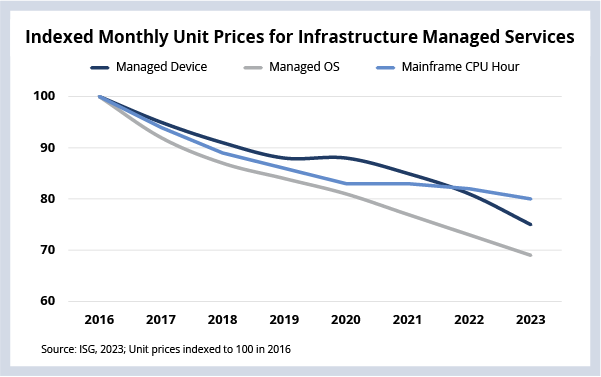

IT infrastructure outsourcing prices continue their downward trajectory despite the macroeconomic and geopolitical disruptions over the last four years.

DATA WATCH

Background

The last four years have seen a dizzying array of macroeconomic and geopolitical disruptions: a global pandemic, a massive global supply chain crisis, the largest conventional military attack since World War II, an energy crisis and the highest level of inflation in the U.S. since 1981.

But, as you can see in this week’s Data Watch, these events have had little impact on IT infrastructure outsourcing prices. Much like it has over the past two decades, the price to manage a resource unit – be it a device, an operating system instance or a mainframe hour – has continued to decline.

There are lots of ways to explain this. The most important factor here is that – on the whole – cost optimization remains the primary reason companies outsource in the first place. So, it stands to reason that providers must build, scale and continually improve their productivity to deliver these savings.

It’s also important to keep in mind that the sector is more competitive than ever. Dozens of providers can provide technology services to large global enterprises – you can see this reflected each quarter in our ISG Leaderboard and in the hundreds of providers we evaluate each year. This intense competition puts pressure on prices as well.

It’s the combination of all these factors – customer demand, competition and providers’ abilities to scale and improve – that are driving down prices. And this is more important than ever in today’s uncertain macroeconomic climate. It’s a rare event to see an enterprise that does not expect upfront savings as part of its IT outsourcing agreement.

What’s Next

Of course, infrastructure outsourcing pricing is just one area in a very, very big sector. So, as we round the bend on 2023, we’re taking a closer look at how the last four years changed – or didn’t change – other areas of our industry.

For example, we’re seeing some interesting trends in rates – both onshore and offshore. We’re watching as provider delivery models continue to evolve in the face of the Great Reshuffle. And we’re seeing some big shifts in buying patterns that are, in turn, having an impact on deal sizes and durations.

And, of course, we’re closely watching AI – both how it will impact providers and what use cases our enterprise clients are exploring. Chris, the entire ISG team and I hope you can join us next week in Dallas to talk more about these exciting trends.

You can register for the Sourcing Industry Conference here.