Was this email forwarded to you? Sign up here to get the Index Insider every Friday.

Here’s what’s important in IT and business services this week:

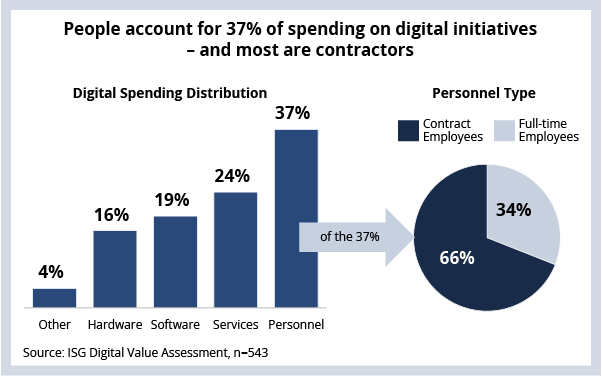

- People account for 37 percent of enterprise spending on digital initiatives

- IBM enters hyper-competitive cloud edge market

- Volkswagen could be Europe’s second largest technology firm by 2025

DIGITAL

Digital is not just about software. People account for 37 percent of enterprise spending on digital initiatives (see Data Watch). Software generates big, non-linear returns in the long run, but to get those big returns, companies need talent to build the software and systems. Digital is still very much a human endeavor.

Acquiring this kind of talent is hard and getting harder as economies emerge from the pandemic and consumer demand picks up. This year's GDP estimates in the U.S. have increased from 4.2 to 6.5 percent. Unemployment also is forecasted to drop to 4.5 percent by the end of the year. Access to digital talent is already tight, and it’s going to get even tighter. As demand outstrips supply, enterprises will likely increase their use of contract labor – which is already 66 percent of personnel spending today.

This is also why we’re seeing so many service providers expand their hiring plans for experienced digital talent and recent graduates. This year Capgemini plans to hire 30,000 folks, a 25 percent increase over 2020; Cognizant is hiring 23,000 people, a 35 percent jump since last year, and Infosys plans to hire 24,000 university graduates compared to last year’s 15,000.

DATA WATCH

CLOUD

IBM has jumped into the hyper-competitive edge computing market with the recent announcement of Cloud Satellite. It is positioning Satellite as a way to “deploy and run apps consistently across on-premises, edge computing and public cloud environments from any cloud vendor.”

The challenge for IBM: Hyperscalers are already at the edge. Similar products like AWS Outposts, Google Anthos and Azure Arc have been in the market for some time. However, IBM’s Cloud Satellite feels like a natural extension of the hybrid-cloud approach IBM began enabling with its Red Hat acquisition in 2019.

Edge computing is gaining traction as companies look to extend processing power to applications and devices closer to where they operate (cars on highways, stoplights on streets, equipment in factories, etc.). The hyperscalers – and now IBM – are racing to capture those workloads.

AUTOMOTIVE

Volkswagen plans to employ more than 10,000 software developers by 2025, which would make it Europe’s second largest technology firm behind SAP. Software is the next big thing for car manufacturers – even bigger than the move from combustion to electric engines. And it's not just limited to autonomous driving and infotainment systems. In-car software increasingly controls the drive train and the car body itself.

Software also goes beyond the systems that are “in car.” Software is used in everything from optimizing aerodynamics to increasing productivity in assembly lines. This is why so many auto manufacturers are betting big on software and ramping up their search for talent and partnerships that can help them build these next-generation systems.

The European Catena-X data alliance – a consortium focused on secure and cross-company data exchange – will accelerate many of the manufacturer-software vendor relationships. Auto manufacturers like BMW, Daimler and VW are partnering with technology providers like Siemens and Telekom as well as OEM suppliers like as Bosch, Schaeffler and ZF to accelerate the secure sharing of data.

On the deal front, OEM supplier Verkor engaged Capgemini to help it speed up battery production in Europe, and Tenneco engaged L&T Technology Services to help build its ride control business. On the manufacturer front, Toyota engaged Cigniti for software testing automation and BMW inked a deal with KPIT to build integrated charging units.

DEAL ACTIVITY

- Newmont Corporation and Infosys. World’s largest gold mining company extends BPM relationship. Link

- London Metropolitan Police Service and Capgemini. $800 million multi-tower consolidation. Link

- ADCO and Rackspace. German sanitary solutions provider moves to AWS and Office 365. Link

- Joyalukkas and IBM. India’s leading jewelry retailer builds new e-commerce platform. Link

- Envision Virgin Racing and Genpact. All-electric racing team extends analytics relationship. Link

- Zenoti and Sutherland Global. Salon and wellness tech unicorn scales customer support. Link

M&A, ALLIANCES

- Workday acquires Peakon. Demand grows for employee listening and feedback platforms. Link

- LG and DXC Luxoft. Automotive joint venture focuses on digital cockpit, infotainment and ride hailing. Link

- HCL and Qualys. Extending enterprise cybersecurity lifecycle relationship. Link

- Tech Mahindra and Perigord. Life sciences BPO heating up. Link

NOTEWORTHY

- Azure update creates half-day outage for subset of Office 365 customers. Reinforces need to architect for failure in the cloud. Link

- McAfee sells its enterprise business. $4 billion sale to consortium led by Symphony Technology Group. Link

- NTT Data launches digital banking platform. Open banking platforms and services in high demand. Link

- Equinix opens sites in Tokyo, Paris and London. Fast-growing co-location provider executing on its $3 billion xScale data center program. Link

- IBM launches first cloud multi-zone region in Latin America. Follows openings in Toronto and Osaka in 2020. Link

- Wipro appoints Pierre Bruno as CEO of European operations. CEO Delaporte continues to build out new leadership team. Link