In this edition: TCV is trending down, but the market is stronger than ever. Atos appoints a new CEO. DXC wins five-year supply chain transformation engagement. CDI and Sopra Steria ride the recent wave of cybersecurity-focused acquisitions.

Did someone forward you this briefing? If so, subscribe here to get a copy of the Insider in your inbox each Friday.

MANAGED SERVICES

As we’ve discussed at length, the managed services market is in a phase of sustained growth. We’re in the thick of earnings season, and most providers are reporting strong growth and even stronger pipelines. That coincides with what we just reported on the 3Q21 Global Index call: managed services is up 22% Y/Y, and we’re projecting 10.1% revenue growth for the full year.

This poses an interesting question for providers and investors: if the market is so strong, why is total contract value (TCV) trending downward? The average TCV of a deal in 2015 was around $66 million. Today it’s just under $50 million. That’s a 33% decline in five years.

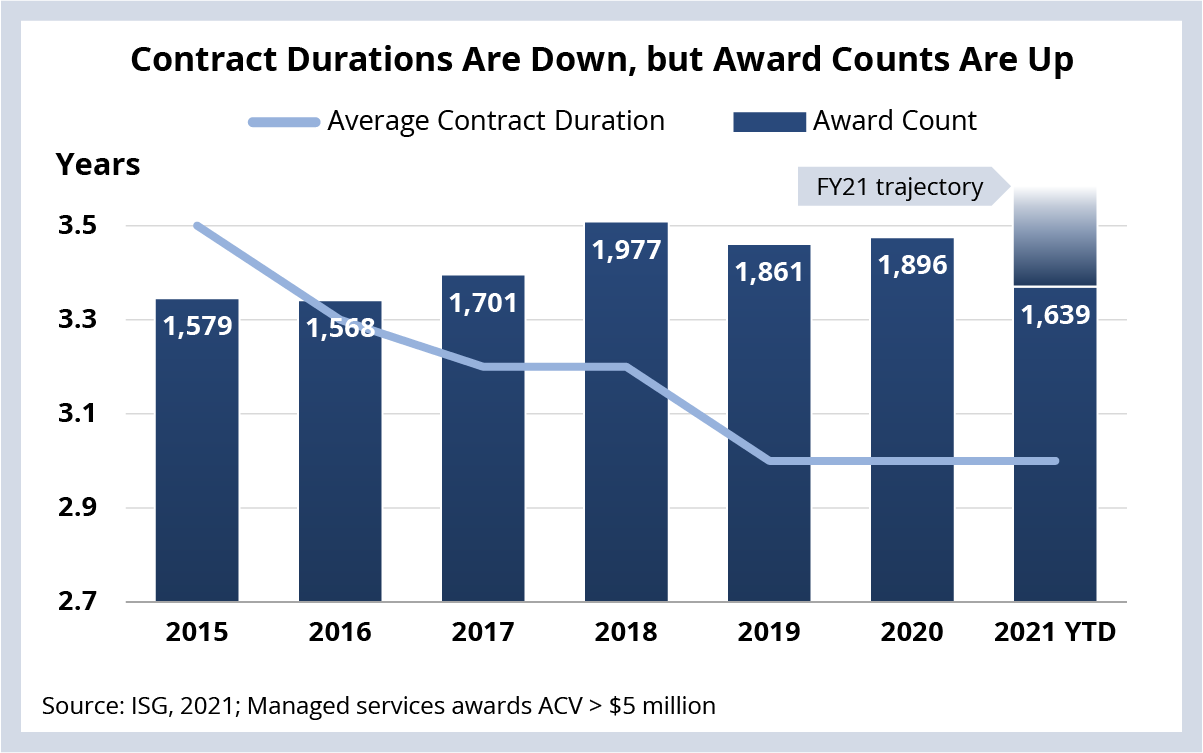

Why is this happening? Contracts are getting shorter. In 2015, the average contract duration was three and a half years. Today it’s around three years. Shortening a contract by just a few months can have a big impact on TCV.

But, while contracts are getting shorter, there are more of them. We set a record with 564 awards signed in 3Q21. And we’re on pace to break the previous record for total number of awards in a year: 1,977 in 2018 (see Data Watch).

This is ultimately why annual contract value (ACV) is a better metric to measure the health of our market. By removing contract duration from the equation, we’re able to see that the market is growing. Managed services ACV is up over 17% YTD and up over 12% compared to 2019.

DATA WATCH

PEOPLE

Atos appoints a new CEO. Rodolphe Belmer will take over for Elie Girard, who submitted his resignation this week (link). Belmer, who is currently CEO of French satellite firm Eutelsat Communications SA, will assume Atos CEO responsibilities in January.

There have been a number of attempts over the past couple years to revitalize growth and increase scale at Atos – most notably the scuttled attempt to acquire DXC back in January of 2021. Atos has also been busy on the M&A and partnership fronts – acquiring several interesting firms over the past several months (including a data engineering firm this week, see M&A section) and launching a number of joint offerings with Google under the Atos OneCloud umbrella. However, financial performance still lags competitors, and the disclosure in April of apparent accounting errors in two of its U.S. businesses only increased the pressure on the firm.

As we’ve said several times over the years, it takes time for senior leadership to enact change across a firm of this size – especially a firm in which people are the primary asset. And, given the fact that two long-standing Atos executives will steer the ship until Belmer arrives, we don’t foresee any significant near-term changes for Atos customers.

DEAL ACTIVITY

- Tnuva and DXC. Israeli food manufacturer modernizing its supply chain with one of Israel’s largest-ever IT services contracts (link).

- Western Asset and Mindtree. Fixed-income investment firm signs multi-year apps and infrastructure transformation deal (link).

M&A

- Sopra Steria acquiring French cybersecurity firm EVA Group (link).

- CDI makes fourth acquisition of 2021 with purchase of ServiceNow security operations firm SecOps Partners (link).

- Accenture acquires procurement technology firm Xoomworks (link), Argentinian e-commerce agency Glamit (link) and Bangalore-based analytics firm BRIDGEi2i (link).

- IBM acquiring Adobe consulting arm of Rego Consulting (link).

- Atos acquiring Czech data engineering firm DataSentics (link).

- CGI acquiring Spanish IT services firm Cognicase Management Consulting (link).

- Avanade acquiring U.K. Microsoft systems integrator QAUNTIQ (link).