Did someone forward you this briefing? If so, subscribe here to get a copy of the Insider in your inbox each Friday.

UKRAINE

While the safety and well-being of the Ukrainian people is our primary concern, we continue to watch closely the impact to the IT sector. There is still IT delivery taking place from Ukraine, primarily from the Western parts of the country. However, the two largest centers of Ukrainian delivery, Kyiv and Kharkiv, are obviously significantly impacted. Providers are showing strong support of their employees in the country and are handling delivery on a project-by-project basis, depending on the needs of the project team members and their families.

And on a personal note, I’m proud of my firm for the support it is providing to humanitarian efforts by matching 100% of ISG employee contributions to two important relief efforts, Save the Children and The UN Refugee Agency.

ATTRITION

As we discussed a few weeks ago, industry attrition rose to an average of 21.2% in Q4 2021. And, while attrition at a few of the largest providers leveled off in Q4, it has continued to increase for most providers; we’re seeing a compounding impact with many ISG enterprise clients.

We asked nearly 60 of our transaction leaders – who are collectively advising $15 billion of TCV a year – how attrition was impacting their clients. So far, the business impact has been primarily in terms of lost productivity and/or delays in projects as providers struggle to staff key roles. It’s no surprise that attrition is also impacting the quality of delivery for ongoing run-the-business work.

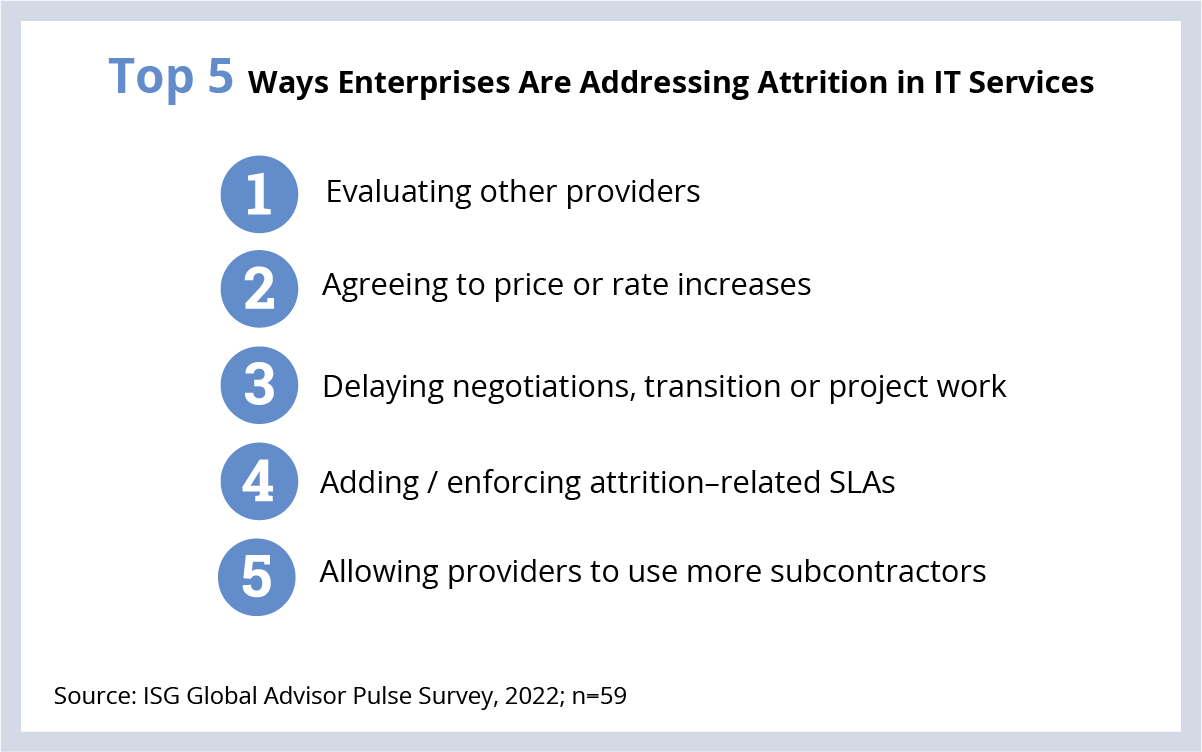

Enterprises are responding in a number of ways (see Data Watch). Many are delaying projects or transitioning into new managed services agreements. Some are focusing on mitigating risk by adding new attrition level SLAs, while others are evaluating new providers. These tactics are likely to be problematic as this is an industry-wide challenge – every provider is fighting to retain talent.

For companies that recognize the IT services landscape has changed in a big way, price or rate increases are becoming more common (recall that rates are up 4 – 7% for in-demand skills), and some companies are allowing providers to use more subcontractors. The attrition challenge is also accelerating new delivery models for many enterprises. A quarter of the transactions leaders we talked to said their clients are accelerating automation plans in response to the attrition challenge.

The silver lining: we do see examples of enterprises revisiting some long-held assumptions about IT and business process outsourcing. For example, some companies are willing to invest more time in upskilling and cross-training provider resources, focus more on integrating provider employees into teams, and recognize that in today’s environment, they are going to need a lot of technology talent to succeed.

DATA WATCH