Did someone forward you this briefing? If so, subscribe here to get a copy of the Insider in your inbox each Friday.

ATTRITION

Now that we’re largely through earnings season for the IT services industry, we can step back and assess the biggest challenge facing our industry right now: attrition. We’re fielding lots of questions – and seeing a number of enterprises impacted by this trend.

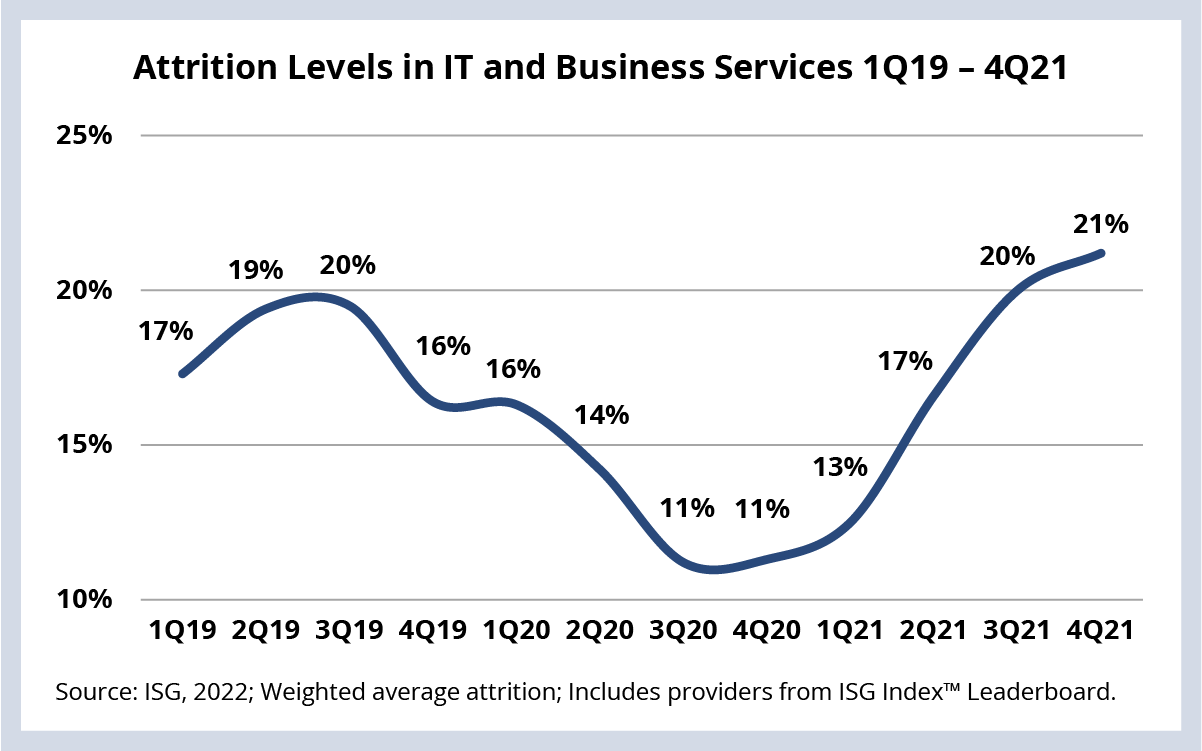

Our model shows industry-wide attrition is now 21.2%, compared to 20.2% last quarter (see Data Watch). This is not a surprise by any means – we said in January that it would be a few quarters before things started to level off.

Attrition rates actually lessened for a small number of the largest providers in our model. However, the remainder all saw attrition increase or stay flat Q/Q. That said, it’s our view that just about all providers are figuring out ways to operate at these heightened levels of attrition. Remember it’s not always just about reducing attrition itself. Providers have levers they can use to address this challenge in other ways – some are just using them more effectively than others.

Another metric we’re tracking is utilization. This is important because some providers are reporting near all-time utilization highs. While that may sound like a good thing, extremely high utilization rates can impact a provider’s ability to staff new work, which means that bookings run the risk of not turning into revenue. What’s interesting is that, for a few providers, utilization rates came down in 4Q22, which could be an indication that many of the entry-level hires who onboarded in the second half of 2020 are moving from training mode into delivery mode.

We’ll have more data and insights into what enterprises are experiencing – and doing – in response to this industry-wide challenge next week.

DATA WATCH