Reminder that next Wednesday is the 1Q22 ISG Index Call. We’ll be discussing contracting, pricing and talent, with a special focus on cybersecurity. We hope you can join us. Register here.

CONTRACTING

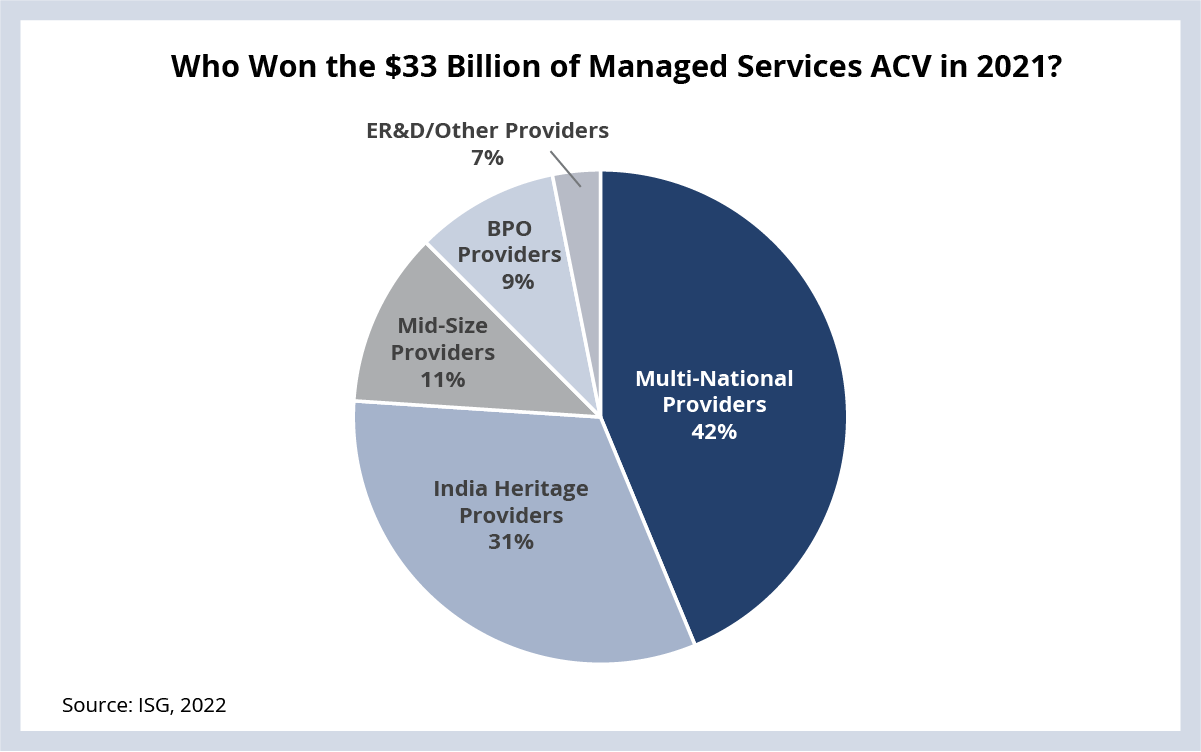

Nearly $33 billion of managed services ACV was signed in 2021. This was a record high as the IT services industry emerged from the pandemic stronger than ever. But it’s worth noting that this ACV was not evenly distributed across the global provider ecosystem. As we’ve discussed in the past, our industry is exceptionally competitive, with each group of providers having its own unique strengths and weaknesses.

For the year, the breakdown looked like this: multi-national providers (e.g., large U.S. and European firms) won approximately 40% of the ACV; India heritage firms (e.g., TWITCH) won approximately 30%; mid-size providers and BPO pureplay firms won approximately 10% each; and ER&D and other providers won the balance (see Data Watch).

We’ll be discussing this breakdown on the 1Q22 Index call, so hope you can join us.

DATA WATCH

CYBERSECURITY

Recently, we interviewed 20 Global 2000 CISOs and senior security leaders to get their view on a number of red-hot topics. One area we focused on was the distribution of their outsourced security spend. Not surprisingly, almost half of enterprise outsourced cybersecurity spending, on average, is going to security operations center (SOC) and security information and event management (SIEM) services.

Every other spending category drops to 15% or less. For example, about 13% of enterprise outsourcing spending goes toward endpoint management. Less than 10% is spent on cloud security services.

We think these distributions are going to change – a lot – over the next couple of years. And that’s because companies are moving to a new delivery model for managed cybersecurity services. It’s called a “cyber fusion center.” A fusion center is a combination of legacy cybersecurity functions and higher value functions (like identity governance and threat intelligence) delivered in a co-located model.

That’s a big change for both enterprises and providers. And we believe it’s going to create a lot of opportunity. We’re tracking around $4 billion ACV with cyber in scope that’s coming up for renewal over the next couple years. We expect that work to look a lot different than it did in the past.

Doug Saylors – ISG Cybersecurity Partner – will be joining us on the Index call next week to discuss the topic. And I hope you can join us in July for one of our newest events, the ISG SICE Summit, where we’ll be focusing on the convergence of cloud, cybersecurity and networks.

CONTRACTING / M&A ACTIVITY

- French food services firm Sodexo consolidating SAP on Azure with TCS (link).

- Danish pharmaceutical company Novo Nordisk signs workplace agreement with HCL (link).

- KKR and Global Infrastructure Partners complete acquisition of co-location provider CyrusOne (link).

- NTT Data acquires U.S. based application/CX firm Vectorform (link).

- Argano acquires U.S. application and integration specialists MS3 (link).