5 Ways to Optimize Application Sourcing Costs in an AI-Enabled Market

Application sourcing —software, support, labor and managed services — presents a prime opportunity to reduce spend and improve value realization.

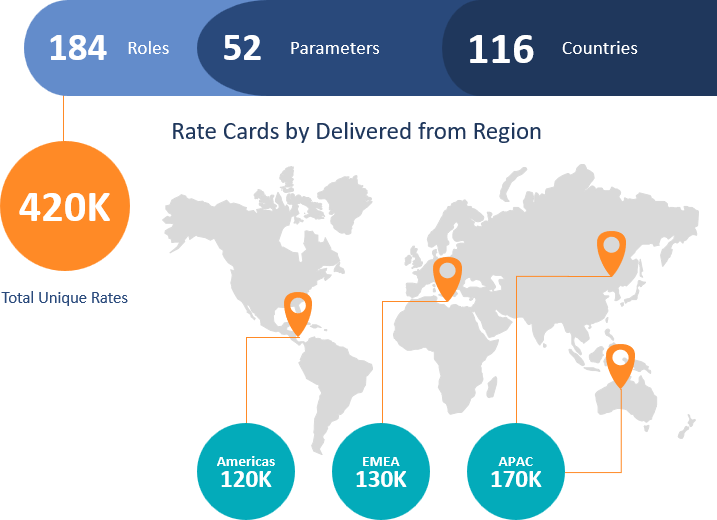

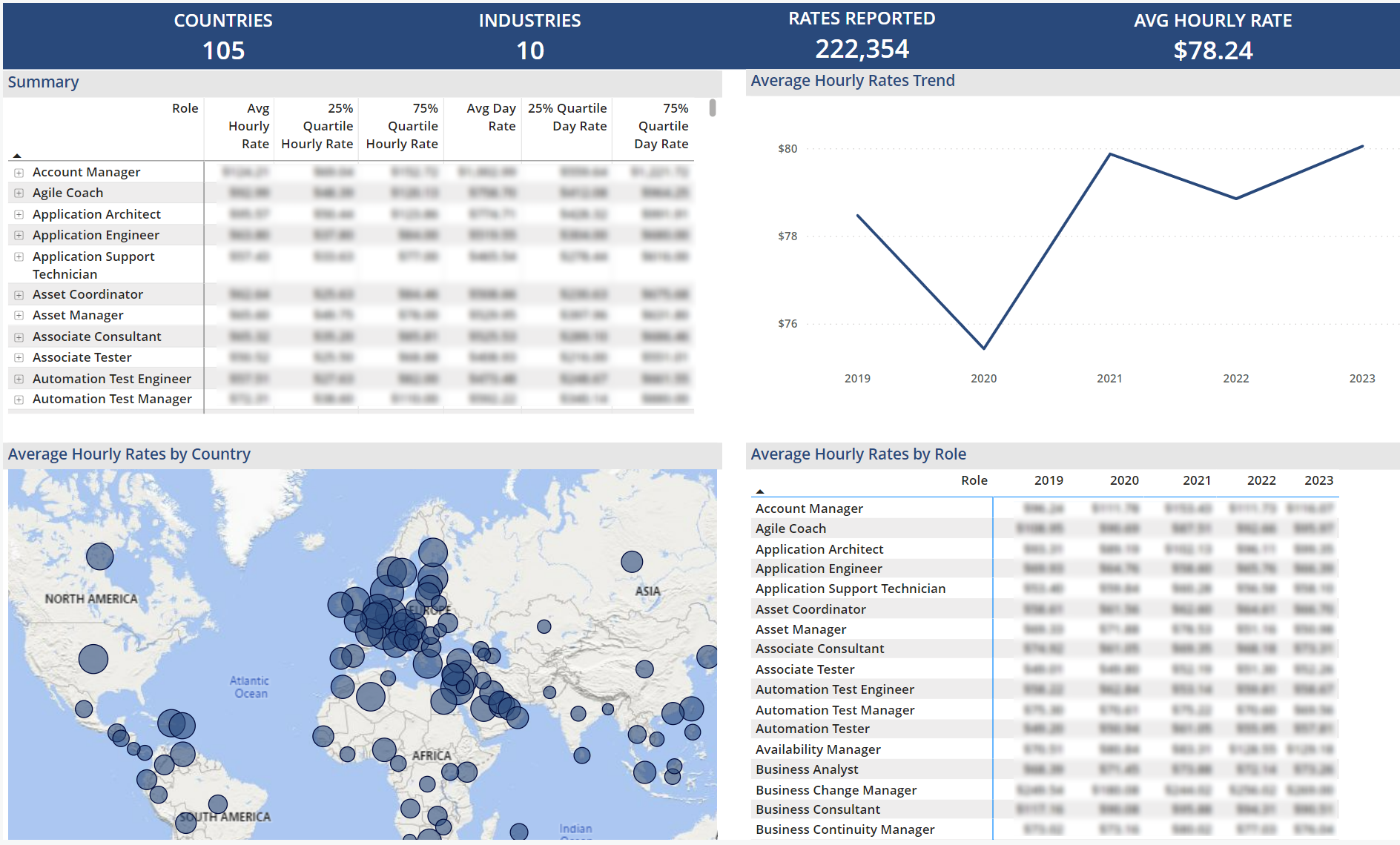

ISG's Rate Card Database sets the industry standard for accuracy and reliability. Our proven methodology, honed over decades of benchmarking experience, allows us to establish baseline profiles and compare your organization's performance with current market data.

Service Areas

Key Parameters

Service Areas

Key Parameters

Industry Groups

ISG is a leader in proprietary research, advisory consulting and executive event services focused on market trends and disruptive technologies.

Get the insight and guidance you need to accelerate growth and create more value.

Learn MoreAgentic AI is emerging as a transformative force that redefines how organizations think, decide and act. Unlike traditional automation or GenAI, agentic AI systems are designed to autonomously execute business processes, dynamically pursue goals and collaborate across workflows. This shift to agentic AI marks a new chapter in enterprise intelligence, where decision velocity, contextual awareness and orchestration become the cornerstones of competitive advantage. Agents are capable of breaking down objectives into smaller tasks, planning execution strategies, interacting with multiple applications, collaborating with other agents and adapting to feedback. In this sense, agentic AI is designed to function more like a digital employee than a static tool. Although still an emerging market, with experimentation outpacing scaled adoption, agentic AI has already begun to shape the future of how organizations think about productivity, decision-making and business transformation.

Data governance is an issue that impacts all organizations large and small, new and old, in every industry, and every region of the world. Data governance ensures that an organization’s data can be cataloged, trusted and protected, improving business processes to accelerate analytics initiatives and support compliance with regulatory requirements. Not all data governance initiatives will be driven by regulatory compliance; however, the risk of falling foul of privacy (and human rights) laws ensures that regulatory compliance influences data-processing requirements and all data governance projects. Multinational organizations must be cognizant of the wide variety of regional data security and privacy requirements, not least the European Union’s General Data Protection Regulation (GDPR). The GDPR became enforceable in 2018, protects the privacy of personal or professional data, and carries with it the threat of fines of up to 20 million euros ($22 million) or 4% of a company’s global revenue. Europe is not alone in regulating against the use of personally identifiable information (other similar regulations include The California Consumer Privacy Act) but Ventana Research’s Data Governance Benchmark Research illustrates that there are differing attitudes and approaches to data governance on either side of the Atlantic.

Data governance is a hot topic these days. In fact, we are conducting benchmark research on the subject here. With increasing regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), organizations face more external oversight of their data governance practices. The risk of significant fines associated with these and other regulations, coupled with organizations’ internal compliance requirements, has brought more attention to data governance practices. We anticipate through 2023, three-quarters of Chief Data Officers’ primary concerns will be governing the privacy and security of their organization’s data.

Let's be blunt: The pressure to adopt AI in HR is a panic button being hit by the C-suite. The mandate from the boardroom is clear, and the pressure is intensifying: HR must adopt AI to remain competitive. This directive often lands on the desks of HR leaders who are already managing complex environments, creating a dangerous disconnect between executive ambition and operational reality.

Revenue organizations are running out of room to hide. With increasingly complex buyer journeys, longer sales cycles and rising expectations for personalized outreach, today’s CROs face a mounting challenge: deliver predictable growth in a market that’s anything but predictable while simultaneously building a team that doesn’t burn out.